[ad_1]

Patriot Payroll, though not as well-known as some of its competitors, is a product that allows small businesses to utilize a suite of effective and simple payroll tools. Available in two different subscription tiers, Patriot makes managing employee payments easy.

Indeed, despite its affordability, Patriot delivers numerous high-quality features — including unlimited payrolls, free expert support and free account setup — that can be invaluable for small organizations.

Jump to:

Review methodology

This review is based on my own research and experience with Patriot, including an analysis of Patriot’s features and a comparison of Patriot alongside other popular payroll services. While I have not used Patriot Payroll in a workplace setting, I have familiarized myself with Patriot’s payroll software as much as I can in order to write this review.

What is Patriot Payroll?

Patriot Payroll is a dedicated payment platform that allows small businesses to organize teams, make payments digitally, manage salaries and bonuses, and so much more. Patriot is an affordable and quality alternative to other payroll services.

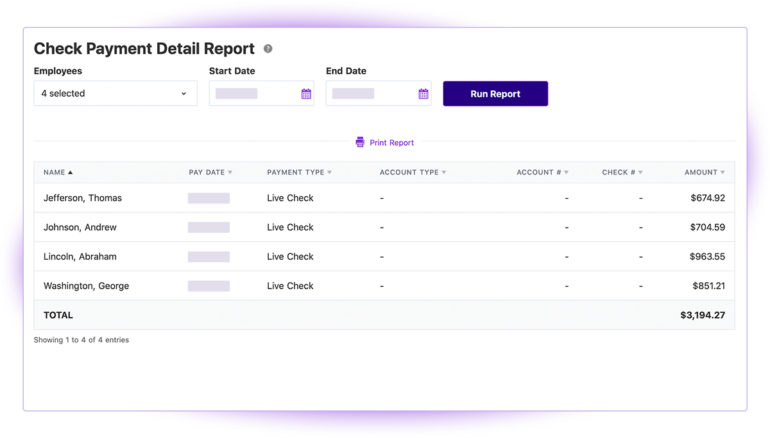

Patriot’s payroll software differentiates itself by providing great value for a low monthly price. Any business or IT professional that signs up for Patriot Payroll will discover the immediate benefits — easy setup, unlimited payrolls and free direct deposit (Figure A), to name a few — but there are more valuable features of Patriot that might take you a while to utilize.

Figure A

This Patriot payroll software review will help shed light on the tools within Patriot which help to manage business payments, as well as the pros and cons of using the service.

Pros and cons of Patriot Payroll

Pros

As mentioned above, there are many pros of using Patriot Payroll software. These include the following:

- Affordable pricing.

- Unlimited payrolls.

- Free setup, either with the Patriot’s startup wizard program or by giving your information to a Patriot professional.

- Employee portal where workers can see payments, history, tax forms and more.

- Contractor payments.

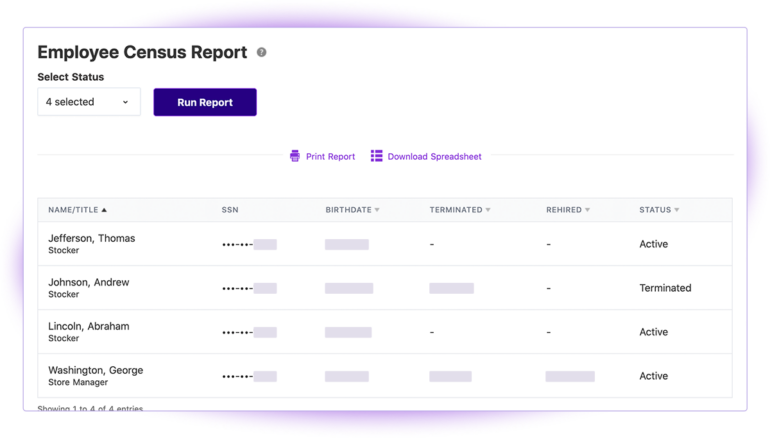

- Employee management (Figure B).

Figure B

Cons

There are also negatives to be aware of before you purchase Patriot Payroll software:

- Some of Patriot’s services require an additional payment, including services like HR integration, support and time/attendance.

- Organizations are forced to purchase the Full-Service Payroll plan to gain access to tax filing and depositing, though this option is still cheaper than many competitors.

In truth, the cons of Patriot Payroll are slim. There’s a reason why Patriot has maintained such a quality rating, and it’s because the service provides great value for an affordable price.

Patriot pricing and plans

There are two different plans available for Patriot customers. These are the Basic Payroll and the Full-Service Payroll plans. Though they include many of the same tools, there are a few differences.

The Basic Payroll plan is $17 per month, with an additional $4 for every employee added. This plan includes all the must-have features — free support, easy setup, accounting tools, multiple payrolls, employee portals, direct deposits and time-tracking. Unfortunately, this plan does not allow companies to manage and file taxes, including payroll taxes, with Patriot. This can be a necessary tool, especially for small businesses that are expecting to grow.

The Full-Service Payroll plan is $37 per month, with an additional $4 for every employee added. This plan includes everything that its predecessor does, though also gives businesses the added benefit of having their taxes, both state and federal, handled for them.

Patriot Payroll features and capabilities

Many of the features and capabilities of Patriot Payroll software are detailed above, though there are some important things to note about other tools within the service.

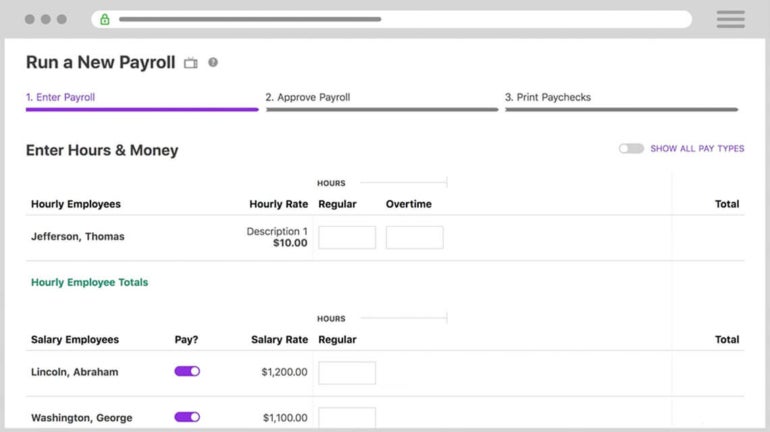

Many of the features within Patriot allow you to customize your payments and employee structure with ease (Figure C).

Figure C

Departmentalization

Patriot Payroll software allows customers to divide their organizations into departments, assign employees to these groups and keep track of spending for each division. This feature might not seem particularly interesting, but it can give you more control over your business and help allocate money to deserving teams.

Mobile workflow

Patriot Payroll does not have an app, though its website does support mobile browsing. With mobile compatibility, you can manage payments, tax forms, bonuses and more from anywhere.

Mobile use of Patriot Payroll software also extends to employees, who can access their personal portal and payment history on-the-go.

Versatile payment options

Patriot supports free four-day direct deposit and two-day direct deposit for some customers. This wait time is much lower than other competitors, and is easy to set up. In addition, business leaders can also pay their employees through checks, printed or handwritten, within Patriot.

401(k) integration

Patriot Payroll, even on the cheaper subscription plan, allows small businesses to integrate 401(k) advancements, making retirement planning a breeze. This is a great feature for companies that expect to grow or maintain employees long-term.

Patriot Payroll is also capable of handling vast amounts of data. This review has mentioned unlimited payrolls multiple times, but Patriot is also able to support numerous employees, departments, teams and pay rates. The service, though cheaper than competitors, is no less powerful.

Patriot Payroll use cases and audience

There are many use cases for Patriot Payroll software. As with all payroll platforms, Patriot can be used to organize data, make payments and track employee benefits. In addition, however, Patriot can also be used to:

- Track work and provide year-end bonuses.

- Grow a small business by providing retirement plans and employee organization.

- Organize and visualize payments and workflow.

With this comes the audience for Patriot Payroll, which is relatively self-explanatory. Patriot’s software is useful for IT professionals, business leaders and new businesses that are all operating with small teams. These teams can benefit from the affordability and resourcefulness of Patriot Payroll.

Alternatives

There are a few alternatives to Patriot Payroll that offer similar services. Gusto is one such alternative, with a suite of tools that help businesses transition to payroll management (Figure D).

Figure D

In fact, Gusto even has a few tools that Patriot doesn’t have, such as performance reviews and automatic tax filing. However, Gusto reserves many of its best services for its highest subscription tier, which is nearly double the price of Patriot.

Even the platforms that are meant for smaller businesses, like OnPay, aren’t as affordable as Patriot. OnPay is easy to manage and a reasonable competitor, but there are just too many things that Patriot does better. Even the premium plan with Patriot Payroll is cheaper than OnPay’s base price. Additionally, OnPay’s technical support is lacking, and customer support isn’t offered on weekends.

For small businesses on a budget, Patriot Payroll makes sense. It can help you manage your team with ease, and it can help businesses scale too.

Should your organization use Patriot Payroll?

My experience with Patriot Payroll has made it clear that the software is not for every organization. Large companies will need more security and customization from their platforms, which Patriot does not necessarily provide.

Patriot Payroll is instead a fantastic option for small organizations that are looking to grow or that are comfortably sized for their purposes. It is a shockingly affordable service that delivers amazing tools to customers.

For more payroll-related fun in 2023, have a look at the best free payroll software for small businesses and the best payroll software.

[ad_2]

Source link