[ad_1]

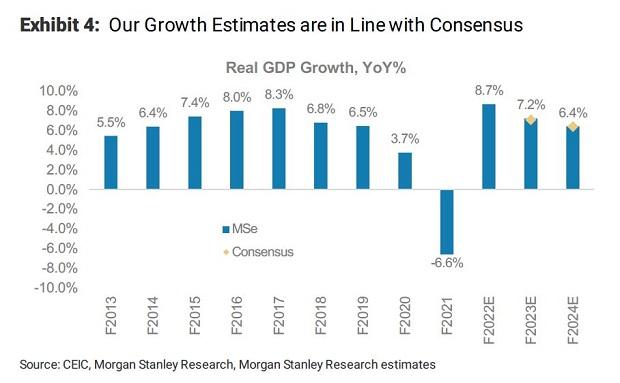

After Nomura slashed India’s 2023 GDP growth forecast to 4.7 per cent from its earlier projection of 5.4 per cent amid recession fears and rising interest rates, analysts at Morgan Stanley, too, have lowered their GDP growth estimates. They now expect the Indian economy – as measured by GDP – to grow at 7.2 per cent in fiscal 2022-23 (FY23), 40 basis points (bps) lower than their earlier estimates. For FY24, the revised projection stands at 6.4 per cent – down 30 bps.

“We see downside risks emanating from a weaker than expected global growth trend, supply-side-driven commodity price shock and faster than warranted tightening of financial conditions,” wrote Upasana Chachra, chief India economist at Morgan Stanley in a coauthored note with Bani Gambhir.

Global growth, Morgan Stanley said, is likely to slow to 1.5 per cent YoY in quarter ending December 2022 from 4.7 per cent in the quarter ended December 2021. Slower trade growth, tighter financial conditions and changes in commodity prices are the three main reasons, it said, is why they see the pace of global growth slow going ahead.

That said, support from the government’s supply-side policy response back home and the reopening activity is likely to cushion the fall in economic growth, Morgan Stanley said. Another silver lining for the Indian economy, according to them, is the fall in commodity prices, which will help sustain the economic momentum.

“We expect reopening vibrancy to help the informal sector, in turn supporting consumption growth, especially in the services segment. The government’s policy reforms and expansion of public infrastructure spending alongside a trend of supply-chain diversification should provide support to private capex,” Chachra and Gambhir wrote.

Morgan Stanley expects the CPI inflation to average 6.5 per cent in F23, as compared to its forecast of 7 per cent earlier. However, they do not expect much change in inflation beyond FY23, and expect it to average 5.3 per cent in FY24. The near-term risks to the inflation trajectory, it said, stem from changes in commodity prices and/or domestic food prices.

“We expect the near-term inflation trajectory to be lower than previously estimated, given deceleration in commodity and food prices. As such, we expect CPI inflation to be just shy of the 6 per cent mark from Nov-21 onwards. However, we highlight that risks to the same could emerge from unexpected changes in the food price trajectory,” Morgan Stanley said.

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

[ad_2]

Source link