[ad_1]

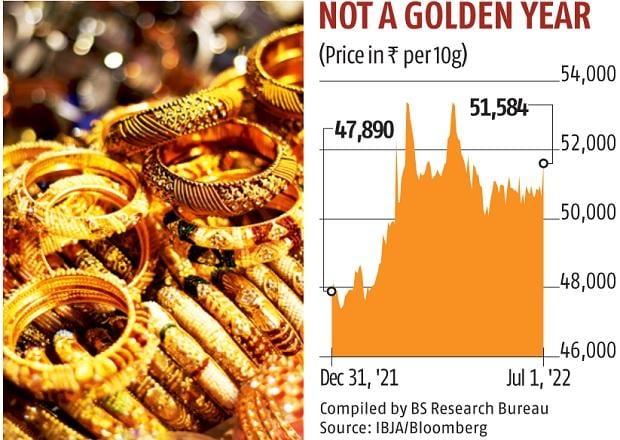

The sharpest increase in the import duty on gold by the Centre saw the yellow metal’s price rising sharply in the domestic market on Friday. The government had hiked basic Customs duty on gold by 5 percentage points via a notification on June 30. Gold domestic futures jumped by about 3 per cent to over Rs 52,000 per 10 gram in initial trading.

By evening, it was trading 2.2 per cent higher at Rs 51,620, while the spot price in Mumbai closed 1.83 per cent higher at Rs 51,584. Interestingly, experts said the price rise should have been higher but for certain factors, which may keep prices under check in the near-term.

Friday’s move is among steps to curtail domestic demand for gold, following the increase in gold import bill in the financial year 2021-22. Since the last two financial years, India’s gold import bill has been more than 8 per cent of the total import bill, and it is also putting pressure on the dollar-rupee exchange rate. The import duty hike on gold should be seen in this context, feel experts.

While the government kept the import duty on silver unchanged, it has withdrawn the 0.75 per cent social welfare surcharge, which takes the total import duty on gold to 15 per cent from 10.75 per cent earlier. Along with these changes, the import duty on gold for refineries has been raised from 6.9 per cent to 11.85 per cent.

Notably, some experts believe that while prices may not sustain at these levels, the ramifications of the duty hike are likely to be negative for the Indian market.

Somasundaram PR, regional chief executive officer (CEO), India, World Gold Council, said, the move to increase duty will have adverse consequences for the gold market and the grey market (unofficial imports) will see a rise.

He said, “The increase in import duty on gold from 7.5 per cent to 12.5 per cent aims to reduce gold imports and ease macro-economic pressure on the rupee. However, overall taxes on gold have risen sharply from 14 per cent to around 18.45 per cent. Unless this is tactical and temporary, it will likely strengthen the grey market, with long-term adverse consequences for the gold market.”

Meanwhile, at the futures market, many traders have been short but a falling rupee is providing support to prices. Moreover, some traders who actively trade based on the gold-silver ratio had sold gold and bought silver. This is because the price of silver was quite low in relation to gold.

They, too, were caught unawares. While some short-covering by these players may have led to the initial surge, prices did not sustain. Market players said the price of gold should have risen by around 4 per cent due to the duty hike. They added that the lower increase may be due to the high domestic inventory.

Kishor Narne, director, Motilal Oswal Financial Services, said, “The sudden surge in duty was taken smoothly by the gold market, as there was excess inventory due to lack of demand over last month. Due to this, full transmission of duty didn’t happen.”

Ajay Kedia, director at Kedia Advisory, said, “Friday’s gain in gold on MCX will be short-lived as this is only because of the duty hike. While this will dent global gold demand, the hawkish tone from the US Fed won’t help gold to sustain in the near term.”

Dear Reader,

Dear Reader,

Business Standard has always strived hard to provide up-to-date information and commentary on developments that are of interest to you and have wider political and economic implications for the country and the world. Your encouragement and constant feedback on how to improve our offering have only made our resolve and commitment to these ideals stronger. Even during these difficult times arising out of Covid-19, we continue to remain committed to keeping you informed and updated with credible news, authoritative views and incisive commentary on topical issues of relevance.

We, however, have a request.

As we battle the economic impact of the pandemic, we need your support even more, so that we can continue to offer you more quality content. Our subscription model has seen an encouraging response from many of you, who have subscribed to our online content. More subscription to our online content can only help us achieve the goals of offering you even better and more relevant content. We believe in free, fair and credible journalism. Your support through more subscriptions can help us practise the journalism to which we are committed.

Support quality journalism and subscribe to Business Standard.

Digital Editor

[ad_2]

Source link